Reporting

Reporting

What is sustainability or ESG reporting? ESG reporting is the disclosure of data explaining a business’s impact and added value in three areas: Environment, Social and Corporate Governance. Just as a company would produce financial reports, ESG or sustainability reports provide a summary of quantitative and qualitative disclosures supported by analysis of performance across these ESG factors.

- Environment: Climate change and carbon emissions, air and water quality, biodiversity, deforestation, energy efficiency, waste management.

- Social: Customer satisfaction, data protection and privacy, gender and diversity, employee engagement, community relations, human rights, labour standards.

- Governance: Board composition, audit committee structure, bribery and corruption, executive compensation, lobbying, political contributions, whistleblower programs.

Many companies chose to integrate their ESG reporting in their annual reporting to demonstrate how sustainability is embedded in their business; however, there is a gap between demand for ESG information and supply. Investors especially, want more financially material and higher quality information to inform their decisions. This gap is driven by several factors including, non-mandatory reporting regimes, costs to collect and report data. As from 2021, there will be more effort to establish a single global reporting standard.

(Source: ‘Why ESG Reporting Is Essential For Your Business‘ published by UL, 05 November 2020)

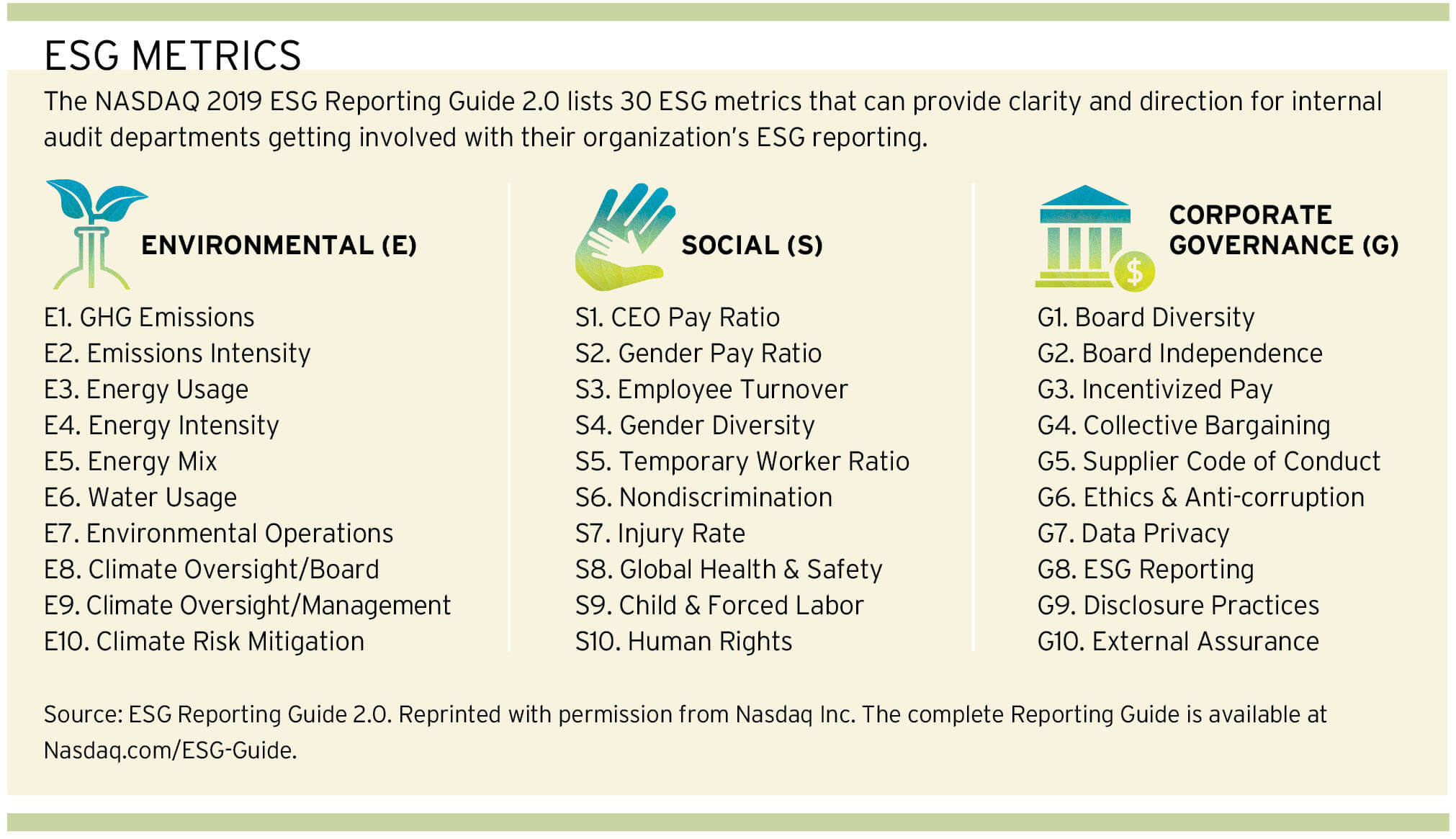

ESG Metrics

The list below, divided into Social, Environmental, and Corporate Governance subsections, is meant to give public companies some clarity and direction when considering ESG reporting. In each instance, it is not just the ESG metric, but a number of related insights:

ESG Reporting Best Practices

Risk Disclosure: When possible, ESG disclosure should focus on a company’s risks and opportunities with sufficient potential to impact the company’s long-term operational and financial performance in light of its business and should discuss the company’s approach to risk management, making the connection, to the best of their ability, between the ESG topics on which they report and the company’s long-term value creation strategy;

Stakeholders: Before preparing its ESG disclosures, a company should consider which audience (or audiences) is the intended recipient of its reports and should tailor the tone and content of its reports accordingly, particularly regarding information that would be most useful for investors or whether for other ESG-oriented stakeholders;

Relevant Information: Preparers of ESG reports should consider how best to liaise with relevant departments and functions within the company to ensure that all relevant information is collected and addressed and that diverse perspectives and inputs are accounted for. However, when it comes to determining whether the information is material or not as a matter of law, that assessment should reside with a company’s legal department;

Language: In their ESG reports, companies should clearly define in plain English technical terms and terms that do not have a universally accepted definition;

Discretion: It is important to allow companies discretion in how they report and discuss ESG information. Each company should maintain the flexibility to determine which ESG factors and related metrics are relevant to it and what disclosure is meaningful for its stakeholders and not necessarily what is identified in various third-party frameworks and standards;

Disclosure: Issuers preparing ESG reports should explain why they selected the metrics and topics they ultimately disclose, including why management believes those metrics and topics are important to the company;

Accessibility: ESG information should be easy for users to find, such as through dedicated ESG disclosure web pages and links;

Verification Process: Finally, a company should consider including in its voluntary ESG reports a description of the company’s internal review and audit process or any external verification of the information that the company received.

(Source: ‘ESG Reporting Best Practices‘ by Tom Quaadman is Executive Vice President and Erik Rust is Director of the Center for Capital Markets Competitiveness, both at the U.S. Chamber of Commerce. Published by Harvard Law School Forum on Corporate Governance, 02 December 2019.)

Knowledge Centre

This section includes CDP, Disabilities in Reporting, ESG, example reports, governance, GRI, IFRS, Integrated Reporting, materiality, non-financial reporting, OECD, SASB, SDGs, SMEs, stock exchanges and technology. The video section includes several explainer videos and the Links page lists the most important reporting standards.

Sustainability reporting by companies is absolutely crucial in measuring progress and evaluating initiatives that have a positive impact on resource management and GHG reductions. Currently, reporting has been focused on ESG (economic, social and governance) with very little on the circular economy. This will improve over time.

References:

- Report: Freepik from Flaticon

- Knowledge Centre: Freepik from Flaticon

- Information: CleanPNG

- Video: Freepik

- Links: Icon Finder